PVC piping is an inexpensive method of removing and providing water in current homes as…

Insurance and Mold

“Is this covered by Insurance?” is a question often posed to Eradicator inspectors by clients that have home insurance. Often our answer is “It depends, its best to ask your insurance agent.” The extent of mold coverage will depend on the insurance policy taken out by the insured. After further investigation a claim can be denied or approved after determining the cause of the abnormal mold activity.

Covered or not?

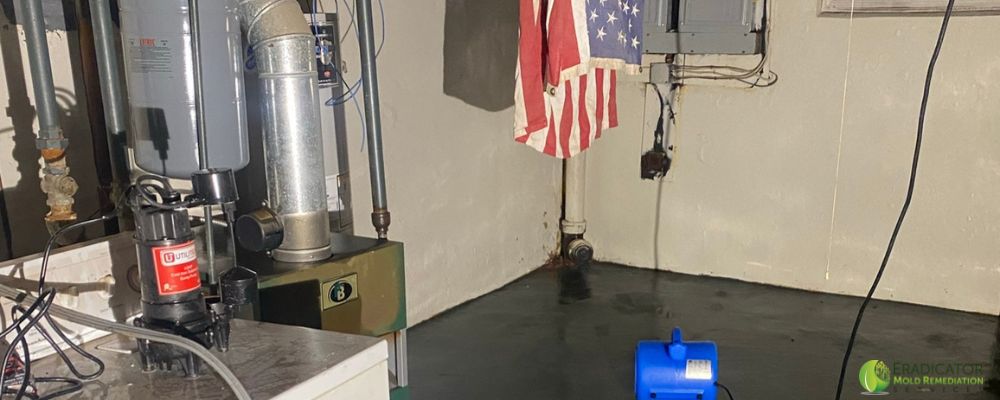

Usually when a client assumes they have a case that requires mold assistance they should call their insurance provider. An insurance adjuster will determine if the coverage provided covers mold remediation expenses incurred. An influx of water within your basement (boiler leaking or a burst pipe) are examples of scenarios that are unpredictable. These scenarios more than likely will be covered as they would be considered an accident. Once approved the necessary steps will be taken to remove and discard of the affected items. Possible mold growth due to the scenarios that occurred should be approved. The Homeowner may be responsible for damages that occurred if abnormal mold activity is due to a failure to inspect and/or maintain your property. This proves the property owner neglected to resolve the problem that caused the abnormal mold activity. Examples may include an ongoing roof leak or not properly venting your bathroom exhaust fan to the exterior of the home as opposed to the attic.

Do I need additional coverage?

While an average insurance policy does not come with mold coverage it may be requested especially if you reside in a region that is prone to flooding, has consistent rain throughout the year, and your property has even experienced abnormal mold activity in the past due to excess humidity. If you need an assessment then feel free to contact one of our experienced mold inspectors, we will work closely with your insurance company to determine the extent of your damage, what it will cost to return your property to a normal level of fungal activity, and how quickly we will make it a reality.